Why choose Purple Visa Card for your travels?

Earn rewards, enjoy exclusive offers, and travel smarter with Singh Travel + Purple Visa Card.

Super Flexible

From earning rewards when you shop, to having the flexibility of long-term Interest Free finance for those larger purchases,* the Purple Visa Card has never been more flexible.

Long Term Interest Free Deals

Use your card for everyday purchases and earn Purple Dollars on Eligible Visa Transactions.

Long Term Interest Free Deals

If you already have a Purple Visa Card Account, visit your nearest Singh Travel store and ask about the latest long-term Interest Free deal.

Shop with Purple Visa Card at Singh Travel

Purple Visa Card, the credit card that gives you more rewards and flexibility.

Not only can you use your Purple Visa Card for everyday purchases and earn rewards everywhere* you shop, but you also have the option of Long Term Interest Free Finance.

Terms and Conditions

Things to Know:

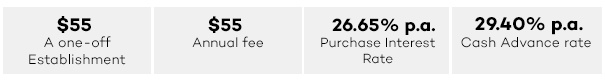

*Long Term interest free finance with minimum purchase applies using Purple Visa Card. Purple Visa Card Terms and Conditions, credit criteria and Rates and Fees apply. Prevailing Purchase interest rate will apply to any outstanding balance at the expiry of the interest free period. Visit purplevisa.co.nz for more information. Purple Dollars cannot be earned or redeemed on long-term interest free purchases. Purple Visa Card is issued by SBS Money Limited.

A 1.5% transaction fee is charged by Singh Travel for any transaction.

Rates and Fees (current as of 1 April 2024 and subject to change)

Payment

Minimum monthly payments (3% of the outstanding balance or $20, whichever is the greater) and any charges eligible for deferred payment will not apply until expiry of any Deferred Payment Plan but must be made during the Interest Free Term. If you make only the minimum monthly payment, you may not pay off your purchase before the expiry of the Interest Free Term. So, if you can, always pay more than the minimum amount due. Visit purplevisa.co.nz for more information.

Your Questions, Answered

Find quick answers about using your Purple Visa Card for travel bookings, rewards, and more.

Applying for a Purple Visa Card is easy. You can apply by clicking here or you can call us on 0800 801 808 and one of our Customer Experience Team members will be happy to talk you through the application process. You must be at least 18 years old, a New Zealand citizen or permanent resident living in New Zealand, and earning or receiving a regular income.

Yes, you can use your credit card overseas wherever Visa is accepted. We do recommend that you inform the Purple Visa Card team when you are going overseas – this will help them identify if there are any suspicious transactions on your account.

Some fees apply when you use your credit card overseas. Please refer to the Rates and Fees associated with your credit card for a complete list of fees for overseas transactions. Purple Visa Credit Card Terms, Rates and Fees

For all rates and fees that may apply to your account, please refer to the current Purple Visa Card Rates and Fees.

You can update your contact info via eMoney Secure Message, email, letter, or by calling 0800-801-808. To request a credit limit change, you must be the main cardholder, pass lending criteria and have made at least six consecutive payments above the minimum due.